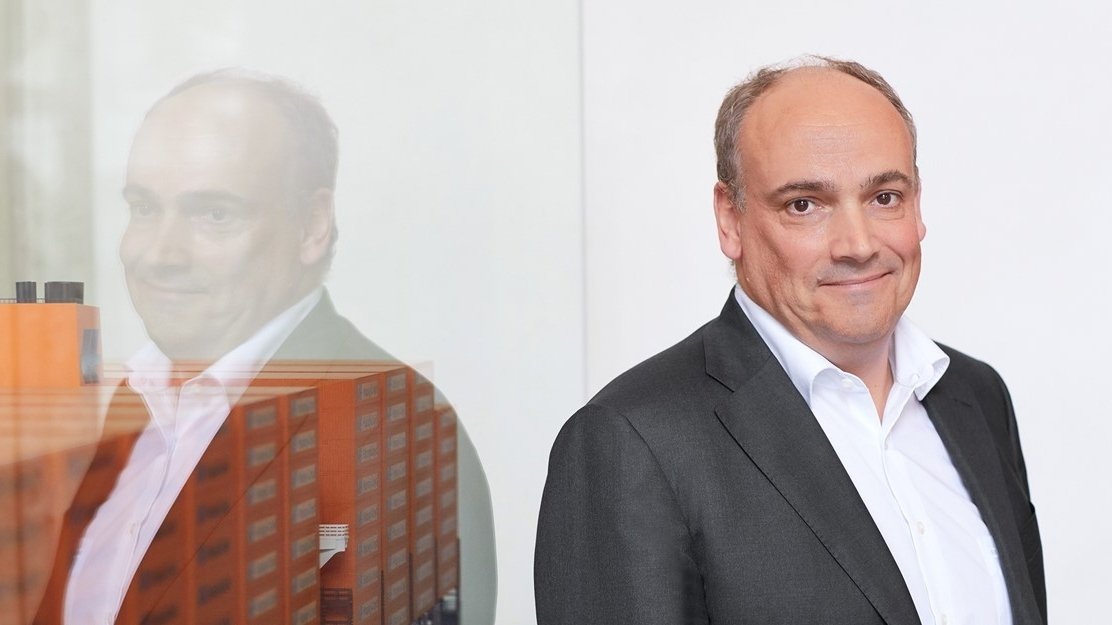

Octopus AIM VCT plc Reveals Its Unaudited Net Asset Value

Our source has recently released an update on Octopus AIM VCT plc, a renowned venture capital trust. As of 26th February 2024, the firm’s unaudited net asset value (NAV) of its Ordinary shares stood at approximately 62.6 pence per share. This significant financial update offers our readers, especially current and potential investors, a glimpse into the organization’s per-share value at a specified time. It plays a crucial role in reflecting the entity’s financial health and future growth potential.

Understanding the NAV

For those who might not understand, NAV, or Net Asset Value, is an essential term in the finance and investment world. Essentially, it represents a company’s total assets minus its total liabilities. It is the value that would theoretically be available to shareholders if the corporation was liquidated. In the context of Octopus AIM VCT plc, expressing its NAV per share lets us know precisely how much each share would be worth if the firm decided to sell all of its assets and pay off all of its obligations.

Effects of NAV on Investors

Why might any of this matter to an average investor? While the NAV per share might seem like just a number, it is much more substantial in the realm of investment. NAV can greatly influence the decisions of current and potential investors. It gives them an accurate idea of a company’s financial health, helping them understand whether or not they should invest or stay invested in such a company. If the NAV per share is growing, it can signal that the company is well-managed and capable of enhancing its asset value, which can lead to higher returns for the investors.

Looking at Octopus AIM VCT plc

Octopus AIM VCT plc is no different when interpreting its announcement. The 62.6 pence per share figure isn’t just a statistic – it’s a clear indicator of the firm’s financial well-being. Our source’s update on this financial metric provides both current and prospective investors with valuable insights into the venture capital trust’s operations.

On Future Growth Potential

The revelation of the NAV per share also sheds light on Octopus AIM VCT plc’s potential for future growth. If the company intelligently manages its assets and reduces its liabilities, the NAV per share can grow over time, giving both current and potential investors confidence in the firm’s ability to provide a healthy return on their investments.

Conclusion

Undoubtedly, an announcement like this encourages more in-depth analysis and understanding of the company’s financial health and its capacity for providing investors with better returns in the future.